While concern continues to mount about the design and delivery time frame for Australia’s $50 billion Attack Class submarines – the delivery time frame, combined with collaboration with French-based Naval Group, provides an opportunity for a paradigm shift in the development of Australia’s next-generation submarine fleet.

To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

It is the largest defence acquisition project in the history of the nation, but the $50 billion project to replace the ageing Collins Class submarines with 12 regionally-superior submarines is in deep water as growing concerns about cost, capability and delivery time frame are further exacerbated with the leaking of information about a $404 million contract break fee.

When then prime minister Malcolm Turnbull announced the DCNS, now Naval Group, conventionally-powered Shortfin Barracuda, now the Attack Class, as the successful design for the hotly contested SEA 1000 Future Submarine program in April 2016, it seemed as if the disastrous procurement of the Collins Class would be put aside.

As the then prime minister assured both defence and the Australian public: "The competitive evaluation process (CEP) has provided the government with the detailed information required to select DCNS as the most suitable international partner to develop a regionally-superior future submarine to meet our unique national security requirements."

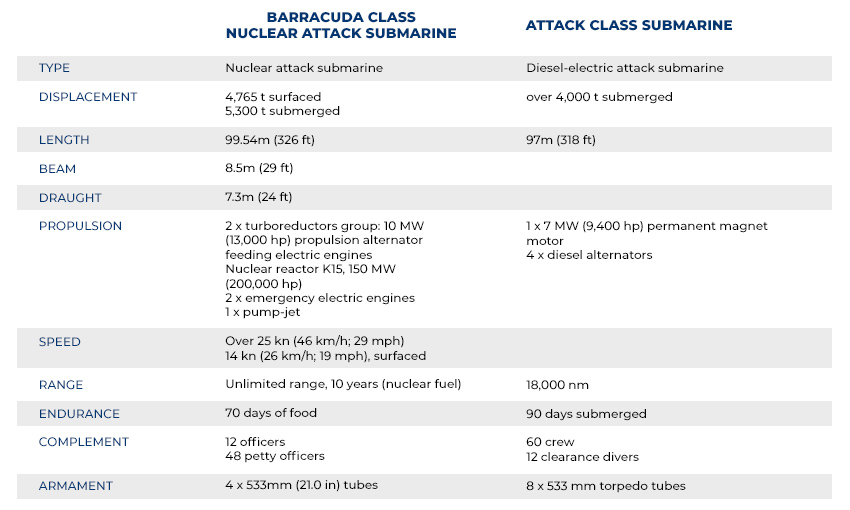

The Attack Class is expected to deliver a quantum leap in the capability delivered to the Royal Australian Navy and its submarine service by leveraging technology and capabilities developed for nuclear submarines, implemented on a conventional submarine. France's own projected fleet of Barracuda Class serve as the basis for Australia's own Attack Class with one major difference, nuclear propulsion.

However, with the first vessel expected to enter the water in the mid-to-late 2030s concerns regarding the cost, delivery and capability of the vessels is serving to raise questions about the value proposition for a conventional submarine at a time of increasing technological advancement in comparable vessels operated by peer and near-peer competitors in the Indo-Pacific.

Meanwhile, nuclear energy and propulsion has remained a highly contentious issue for Australia – ironic for a nation that is the third largest exporter of uranium in the world and is blessed with approximately a third of the global supply. As a result of this, nuclear energy and nuclear powered submarines have long been avoided by Australia's political leaders and strategic planners despite the immense operational and strategic benefits of such capabilities.

Further compounding these issues is the astronomical unit price of Australia's future Attack Class submarines of between $4.2 and $6 billion per unit (including infrastructure development, research and development costs) – compared with the unit cost of the French Barracuda's of approximately US$1.4 billion ($2 billion) per unit (based on 2013 prices raises questions about the validity and cost-benefit analysis conducted on doubling down with early-20th century technology).

This stubborn resistance to consistently reinventing the wheel and calling it progress will serve to challenge the long-term capability of both Australia's submarine fleet while also cementing a 20th century focused industrial capacity. However, it doesn't have to be this way, as Australia's recently initiated design clarification process, long-lead time for construction and combined with international partnerships provide the opportunity to reset the paradigm.

Plug and play construction, allied collaboration and the future

Contemporary submarine construction, like contemporary naval and civilian shipbuilding, is done predominantly in a modular, 'block build' fashion enabling an easier integration for technology development and enhancements throughout the build phase – what this means is a stark difference between the broader capabilities and technology in vessels over the life of the build phase.

The long-lead time prior to the commencement of the construction process provides a number of additional opportunities particularly for Australia's Attack Class submarines – in particular avoid the costly redesign and conversion phase – purchase the standard Barracuda Class design and make the necessary modifications to incorporate the US-designed weapons systems and combat systems without reinventing the wheel.

Doing so builds on the technological and industrial lessons learned by Naval Group throughout the same process getting Suffren to the launch stage – it wouldn't serve to hinder the build process for Australian industry and would serve to reduce risk for Australia. Additionally, it would provide the opportunity for Australian industry to bring the phase forward by using Australian workers to build the full submarines while drawing on French nuclear propulsion expertise to serve as "technology insert" experts to install the nuclear reactors for the Australian submarines.

The long lead time for this development would also provide an opportunity for Australia to embed both civilian and military nuclear experts and submariners in the nuclear industries and nuclear-powered submarine fleets of key allies including France, the US and UK to develop the expertise and skills required to safely, efficiently and effectively operate nuclear powered submarines.

Looking further abroad, using defence as a proving ground for developing a domestic nuclear power industry provides flow on economic and national security benefits, drawing in the expertise and experience of trusted international partners while minimising the risks for Australia's national security and the tax payers responsible for funding defence acquisition.

Compare the pair – SSN v SSK

A lot of the feedback received in the comments regarding the potential Australian acquisition of nuclear powered attack submarines focuses on the differences between the nuclear- and conventionally-powered vessels – largely focused on the physical size of the vessels often focusing on the stark size difference between conventionally-powered submarines like the Australian Collins, German Type 212 and 214, Japanese Soryu and related class submarines and large American, Russian or British nuclear powered submarines.

The size difference, often in the realm of 2,000 tonnes displacement weight, and the operational limitations imposed on such vessels as a result of the size does not directly translate to either the nuclear-powered Barracuda and the conventionally-powered Attack Class vessels. It is important to clarify the similarities between the nuclear- and conventionally-powered vessels – in particular the Soryu, Barracuda and Attack Class have a submerged displacement of 4,200, 5,300 and >4,000 tonnes, respectively.

Further supporting the 'plug and play' construction of local nuclear-powered submarines is concerns about the conversion of technologies designed for nuclear-powered submarines for conventionally-powered vessels, namely pump jet propulsion systems, combined with the increasing power demands of combat systems and planned addition of advanced unmanned underwater vehicles, which will use the submarines as 'mother ships'.

Further supporting the 'plug and play' construction of local nuclear-powered submarines is concerns about the conversion of technologies designed for nuclear-powered submarines for conventionally-powered vessels, namely pump jet propulsion systems, combined with the increasing power demands of combat systems and planned addition of advanced unmanned underwater vehicles, which will use the submarines as 'mother ships'.

Questions to be asked

As an island nation, Australia is defined by its relationship and access to the ocean, with strategic sea-lines-of-communication support over 90 per cent of global trade, a result of the cost effective and reliable nature of sea transport. Indo-Pacific Asia is at the epicentre of the global maritime trade, with about US$5 trillion worth of trade flowing through the South China Sea and the strategic waterways and choke points of south-east Asia annually.

While the Indian Ocean and its critical global sea-lines-of-communication are responsible for more than 80 per cent of the world's seaborne trade in critical energy supplies, namely oil and natural gas, which serve as the lifeblood of any advanced economy.

Submarines are critical to the nation's ability to protect these strategically vital waterways and key naval assets, as well as providing a viable tactical and strategic deterrent and ensure the nation's enduring national and economic security – recognising this, the previously posed questions will serve as conversation starting points.

However, given the geographic area of responsibility Australia will become increasingly responsible for and dependent on, is the RAN and the recapitalisation and conventionally-focused modernisation program for Australia's submarine fleet enough for Australia to maintain its qualitative and quantitative lead over regional peers?

Traditionally, Australia has focused on a platform-for-platform acquisition program – focused on replacing, modernising or upgrading key capabilities on a like-for-like basis without a guiding policy, doctrine or strategy, limiting the overall effectiveness, survivability and capability of the RAN. Let us know your thoughts in the comments section below, or get in touch with

Stephen Kuper

Steve has an extensive career across government, defence industry and advocacy, having previously worked for cabinet ministers at both Federal and State levels.

Login

Login